Understanding the Different Types of Insurance: Which One is Right for You?

Introduction

- Briefly explain the importance of insurance in financial planning.

- Highlight how different types of insurance serve different needs.

1. Health Insurance

- Definition: Coverage for medical expenses.

- Types: HMO, PPO, EPO, and high-deductible plans.

- Who Needs It: Individuals, families, and those with ongoing health issues.

- Considerations: Premiums, coverage limits, and network of providers.

2. Auto Insurance

- Definition: Protection against financial loss from car accidents or theft.

- Types: Liability, collision, comprehensive, and uninsured/underinsured motorist coverage.

- Who Needs It: All vehicle owners.

- Considerations: State requirements, premium rates, and deductible options.

3. Homeowners/Renters Insurance

- Definition: Coverage for your home and possessions against damage or theft.

- Types: Standard homeowners, renters, and condo insurance.

- Who Needs It: Homeowners, renters, and condo owners.

- Considerations: Property value, location, and personal belongings.

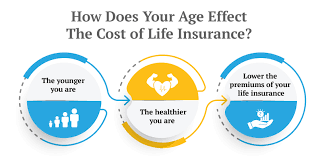

4. Life Insurance

- Definition: Financial protection for your beneficiaries in the event of your death.

- Types: Term life, whole life, and universal life insurance.

- Who Needs It: Individuals with dependents or significant financial responsibilities.

- Considerations: Coverage amount, term length, and premium costs.

5. Disability Insurance

- Definition: Income replacement in case of illness or injury that prevents you from working.

- Types: Short-term and long-term disability insurance.

- Who Needs It: Anyone relying on income to support themselves or their families.

- Considerations: Benefit period, elimination period, and definition of disability.

6. Travel Insurance

- Definition: Protection against trip-related issues such as cancellations, lost luggage, and medical emergencies.

- Types: Trip cancellation, travel medical, and baggage loss insurance.

- Who Needs It: Frequent travelers and those planning expensive trips.

- Considerations: Coverage limits, exclusions, and trip specifics.

Conclusion

- Encourage readers to assess their individual needs and circumstances.

- Suggest consulting with an insurance agent or financial advisor to find the right coverage.

Call to Action

- Invite readers to share their experiences with different types of insurance or ask questions in the comments.